Insurance through super – with choice comes complexity

September 14, 2015Macro risks elevated in 2016

February 16, 2016What is a franking credit?

When an Australian-listed company posts a profit, it is standard practice to redistribute those profits to its shareholders in the form of a dividend. As the profits have already been subject to Australian company tax of 30 per cent the shareholder is entitled to a rebate (partial to full) from the ATO for tax already paid if the individual’s marginal tax rate is less than 30 per cent.

On the dividend statement, the company tax paid is referred to as a ‘franking credit’.

In the case of retirees that pay zero tax, franking credits are 100 per cent refundable, which means they can significantly boost the returns for pension phase superannuation funds.

The importance of franking credits for retirees

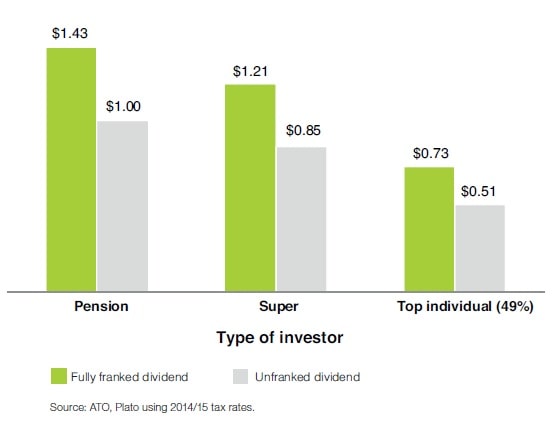

Figure 1 below compares the after tax return of a $1 dividend franked vs unfranked for pension phase investors, super funds and individual investors on the top tax rate of 49 per cent. As you can see, the zero tax rate applied to pension phase investors allows them to benefit most from a fully franked dividend, leaving them approximately 22 cents and 70 cents better off than super and top tax rate investors respectively per dollar of dividend.

Figure 1. The after-tax value from a $1 dividend franked vs unfranked for different Australian investors.

Source: ATO, Plato using 2014/15 tax rates.

How large is franking?

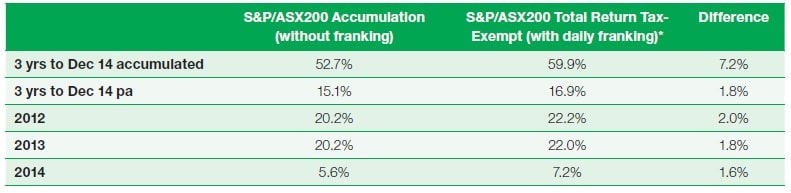

In Table 1, we compare the performance of the standard S&P/ASX Accumulation Index with that of a new ‘tax aware index’ which fully values franking from the perspective of tax exempt investors such as charities or pension phase investors. The additional returns from franking credits are close to the current cash rate and when accumulated over 3 years add an extra 7.2 per cent to returns.

Table 1. Australian shares performance before and after franking

3 years to 31 December 2014

Source: S&P Dow Jones

*S&P/ASX200 Franking Credit Adjusted Daily Total Return Index (Tax-Exempt. Data as at 31 December 2014). Past performance is not a reliable indicator of future performance.

As you can see, over time franking credits can have a significant impact on your returns, in particular for those in pension phase and other tax-exempt investors. Therefore, for retirees and those nearing retirement, you need to understand the benefits of franking and how you can structure your investment portfolios to maximise your after tax outcome.

Speak with your financial planner to discuss how franking credits can impact your investment strategy.

Source: Plato Investment Management